If you haven’t already read them, you’ll probably want to visit Part I, Part II, Part III, and Part IV of this “Tale of 4 Companies: A Job Cost & Gross Profit Drama” before beginning the following “Part V.”

We’re joining Paul (owner of Paul’s Perfect Projects LLC), Walt (Production Supervisor at Paul’s), Jenn (Estimator and Purchasing Agent at Paul’s), and Dave (owner of Dave’s Dandy Results) as they return to the meeting. Click here to see the Estimates vs. Actuals job cost report they’ve been working from…

When it Comes to Weird Job Cost & Gross Profit Numbers – “…The Game is Afoot!”

Walt picked up where they left off before the break. “It turns out,” Walt said, “When you look at these kinds of Estimate vs. Actual reports on a regular basis, you start learning more about how the numbers should look.

Walt picked up where they left off before the break. “It turns out,” Walt said, “When you look at these kinds of Estimate vs. Actual reports on a regular basis, you start learning more about how the numbers should look.

“Odd results just begin to pop out.”

“So the reality is that we actually go LOOKING for weird numbers. Why? Because they let us ‘manage by exception.’

Managing the parts of the job that aren’t working according to plan lets us focus our energy on areas that need our attention.”

“Sometimes, based on what we know about a job, we’ll see a situation where the numbers just look WRONG! That means that we need to investigate.”

“A while back, we had an unfortunate situation where an employee was helping themselves to some of our job materials. That kind of thing is pretty easy to spot when you’re looking at these reports on a week-to-week basis. When everyone knows we’re always reviewing our numbers, it helps keep people honest…”

“That was an unusual circumstance, and we took care of it right away. Upon occasion, we see costs show up in the wrong job, so we make a note of that – for Accounting – so the entry can be corrected.”

“Or sometimes, we know we’ve used a vendor’s materials or services, but we don’t see those costs in the job cost report. We’ll check in with Rhonda to find out if the bookkeeping area is just a bit behind with postings or (more likely), the vendor hasn’t submitted the bill yet.”

Creating Speed, Accuracy & Cost Control With Purchase Orders

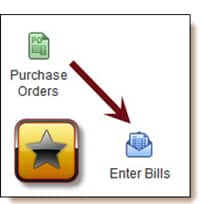

Jenn leaned forward to contribute. “Now that we’re beginning to use Purchase Orders for vendors, we’re also working on a system where we don’t have to wait for them to provide their bills to us. We provide a listing of open Purchase Orders to the Job Supervisors. Then they to let us know which products and services have been received, and when.“

Jenn leaned forward to contribute. “Now that we’re beginning to use Purchase Orders for vendors, we’re also working on a system where we don’t have to wait for them to provide their bills to us. We provide a listing of open Purchase Orders to the Job Supervisors. Then they to let us know which products and services have been received, and when.“

“The idea is to convert POs into bills without waiting on incoming paper or having to nag vendors for their bills. The POs already include the correct job and cost category. That means our bookkeepers can just convert the POs into bills. The costs automatically post to the right job and cost code without having to guess – or wait on info from management.

The result is that our job cost reports are immediately more accurate and up-to-date.

Because we’re paying vendors based on previously agreed-upon amounts, we have automatic COST CONTROL in place.

And, if there are differences between the Purchase Orders and incoming bills, it also helps us spot ‘hidden’ Change Orders. That means the Invoicing for those Change Orders doesn’t get overlooked. Controlling both costs and Change Order income helps us to hit our gross profit goals.

Less Paperwork Means Everybody Wins

We’re also anticipating that our vendors will appreciate having to complete less paperwork. And, we can get them paid faster. Everybody wins!”

Paul nodded. “We’re all in agreement that, although hitting our gross profit targets does NOT guarantee a good net profit, the LACK of a good gross profit will almost certainly guarantee that we’ll be hurting when it comes to having a decent net profit. So we’re pushing to have that part of the system finalized by the end of next quarter.”

Then he glanced at his watch. “Unfortunately, I have an appointment coming up in about 10 minutes that I can’t miss. So let’s fill Dave in on how we use the information AFTER a job is completed. Then we’ll have to wrap up.”

Looking for a prebuilt Chart of Accounts, Cost Codes, and Job Cost Reports

for your QuickBooks desktop software?

Click here or on the image above to check out AccountingPRO™

After-the-Fact: Using the Estimate vs. Actual Report to Improve Gross Profits

“OK, so we’ll make it quick,” said Walt. “A week or so after the end of the job, we first take a look at any remaining Open Purchase Orders for that job.”

“If there are still open Items, we ask Accounting to follow up. Then we still usually wait a week or so before we do the final review. That means we can confirm that all the bills have been received and entered. We want accurate numbers, but we also need to do the reviews while the job is still relatively fresh.”

Jenn jumped in. “We try to focus on the variances that are large enough to warrant our attention. Then we discuss, from a management standpoint, the first obvious question, ‘Did we hit our gross profit target?’ We review both the gross profit percentage and dollars.”

“Those numbers are, of course, extremely important – but we also want to dig deeper into the entire job process. We hash through issues like:

“Which parts of the job didn’t work like we wanted them to?”

“Which parts of the job didn’t work like we wanted them to?”- “What can we do in the future to avoid the same situations? For instance:

- Do we need better procedures?

- Tighter controls?

- Clearer communication?

- Employee training or counseling?

- Tighter or looser scheduling?

- Additional tools or other resources?

- Did the Designers or Estimators receive bad information or make a mistake that we should let them know about?“

- “What did work well? Can we expand on those strengths in the future?”

- “What needs to be modified in future estimates?”

- “Can we use these results in the future if another similar project comes along?”

The idea is to continually improve our estimating, pricing, and internal production processes.”

Are Better Gross Profits in Store for Dave’s Dandy Results, LLC?

“Wow! This is terrific, and exactly what I was looking for! You guys are fantastic!” Dave enthused. “When I came to this meeting, I was looking to…

- See whether I could use QuickBooks in a more creative way so that I could minimize, or even eliminate, my ‘loser jobs’ before they happen.

- I was hoping that I could find out how to access some ‘in-process’ job reports.

- I felt that I needed a reporting system that would help me stay on top of financial and operating information throughout the life of a job – so that I could help my team keep it on track and profitable.”

“The result of this meeting today is that I’m totally blown away! Paul, I know that we had a limited amount of time, but between you, Jenn, Walt, and your bookkeeper Rhonda, you’ve given me far more than I expected.

You’ve shown me a whole new way to look at what my QuickBooks accounting system is capable of – and how I can begin to use it to make A LOT of changes in our operations, pricing, and monitoring. In short, how to convert it into a business management system that we can use to run our entire business!”

Dave’s excitement was contagious, and everyone looked deeply pleased as they shared his enthusiasm over what they’d accomplished.

Let’s Do This!

“I can’t thank you enough for being willing to share what you’ve done here. Every business that’s struggling with profitability needs to discover a friend and mentor like you! I’m heading back to the office to start making these changes as soon as humanly possible, and I’ll definitely keep you posted on our progress.”

Paul responded, “Dave, as a friend of yours, I know that you’ve built a company with terrific products and services. You’ve put your heart and soul into the business. You had to take a lot of risks to get where you are today, and it’s obvious you’ve worked incredibly hard. You were already headed in the right direction…

We just provided a hand-up so that you can move to the next level a little bit faster. I’m really glad that we could find a way to help.”

As Dave packed up and headed out the door, he shook hands with everyone and thanked them again. He got a few steps down the hallway, remembered something, and returned.

“Say, Paul, I almost forgot, and I know you have to get going, but if it’s OK, I’d like to get in touch with you later this week to find out how to contact that ProAdvisor you mentioned a bit earlier in our meeting. I could probably use some help getting these systems up and rolling.”

Paul smiled to himself as Dave headed out to his new (and likely more profitable!) future…

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Diane and her team know the ins and outs of setting up and migrating to QuickBooks. Moving from an existing program is like working on the engine while it is still running. I searched for a company that really understood cost accounting and inventory and found it in InfoPlus. They have the level of understanding and detail that I was searching for. Cost accounting is all about detail and planning, and Diane offered various approaches that allowed us to set up our systems in a common sense way that prepared us for growth. They provided a detailed scope and timeline, worked with our schedule, and provided recordings of our meetings to allow for review and future training. She is also a trusted source for me when it comes to associated software and integrations. She will provide clear feedback and offers many resources for resolving problems that we have encountered as we continue to grow. Her experience and expertise have been a welcome addition that our team can rely on.”

See More Customer and Client Comments

Reminder: Learn more about our construction accounting and manufacturing program classes and discover our job cost support products!