Targeting Gross Profits: How Estimators and Project Managers Focus on Goals & Job Costs at Paul’s Perfect Projects

If you haven’t already read them, you’ll probably want to visit Part I, Part II, and Part III of this “Tale of 4 Companies: A Job Cost & Gross Profit Drama” before beginning the following “Part IV”. As we join Paul and Dave, Rhonda (the company’s bookkeeper) has just shared her perspectives about the new system…

As Rhonda left, Paul said there were two more people he wanted Dave to meet, as they could likely provide additional valuable input on gross profit. He disappeared down the hall. When he returned, he introduced them.

“Dave, this is Jenn, our Estimator and Purchasing Agent, and Walt, our Project Manager.”

“Jenn and Walt, this is Dave. He’s a friend and business associate. He’s looking to see what he can learn about some of the reporting and operations changes we’ve undertaken over the last year or so.”

“Dave’s thinking about implementing some of the same modifications to help increase gross profit in his own company. That’s why I thought I’d ask you to provide your perspectives about how the new systems are working.”

Dave shook hands with Walt and Jenn, said, “Hi, it’s nice to meet you,” and settled in to take more notes. Paul continued, “I gave Dave a copy of one of our standard reports. You look at these on a regular basis – so you can point out any specifics as we go.”

But let’s focus first on how both our estimating and reporting processes have changed.”

“To provide a bit of structure to our meeting, we could use a ‘Before, During, and After’ viewpoint. Since construction cost estimating occurs fairly early on in our sales cycle – why don’t you get us started, Jenn?”

Estimates and Gross Profit: the Targeting Process Begins

“Sure,” said Jenn. “First, I review the design documents and underlying specs., and then I get busy putting the estimated costs together. For labor costs, we use our current, fully-burdened rates. Then we include the hours we estimate it will take to complete each part of the job. Many of our materials and subcontractor costs are based on current vendor agreements, so I use those. But if those agreements don’t exist, I contact the vendors directly to get quotes.”

“Then I enter the estimated cost information into QuickBooks. We have standard markup and gross profit goals, so based on the estimated costs, and the nature of the contract, I enter the estimated income as well.”

Dave leaned forward with a question. “It looks like it must be fairly time-consuming to get that much data entered into QuickBooks.”

Dave leaned forward with a question. “It looks like it must be fairly time-consuming to get that much data entered into QuickBooks.”

“Do you have any tips about how to get all of the details into the estimate in an efficient way?”

She responded, “We’ve developed some memorized estimates that we use as a starting point, so that helps streamline the data entry. I just modify existing line items as needed, delete lines we don’t need and add in any new line items. That helps a lot.

We’ve also been looking at software that will help to automate the entry, but we haven’t pulled that solution into the mix yet. Hopefully, we’ll get that in place within the next few months.

“Ah,” said Dave. “I figured that there must be some tricks of the trade. I’d like to learn more about this later!”

Reviewing the Estimate: Is it Comprehensive? Is it Accurate?

“Happy to help,” agreed Jenn. She continued, “OK, so once I’ve given the estimate my first best shot, I turn it over to Walt. He’s our Project Manager. Quite often, he acts as Field Supervisor as well. Walt – your turn to tell him what you do at this stage…”

“Right,” replied Walt. “I look through the underlying detail in the Estimate form in QuickBooks. First, I review to see that the line items show everything I think we’re going to need. And then the second line items I check are the estimated quantities and hours for each job stage.”

“Basically, I ask myself, ‘Did anything get missed?‘ and, ‘Are the estimated time and materials right?’” “And do you ever find anything?“ asked Dave.

“Well, Jenn’s darn good at what she does, so she’s usually pretty much on target, BUT she’s not on the front lines on a day-to-day basis like I am. So sometimes I can envision or anticipate some aspects of the job that she doesn’t know about.”

“Well, Jenn’s darn good at what she does, so she’s usually pretty much on target, BUT she’s not on the front lines on a day-to-day basis like I am. So sometimes I can envision or anticipate some aspects of the job that she doesn’t know about.”

“I also like to give it some ‘think time’ before handing it back with my notes.

I’m always amazed at what rises to the surface if I give myself time to ask questions like ‘Is anything missing here? Are the goal times realistic? What could potentially go wrong? Do we need to build in some contingencies?’ and so on…”

Modifying the Estimated Costs

Jenn interjected, “Then he sends me an email with his comments, or he shows up in person to let me know which line items need to be modified, and why he’s suggesting changes! We hash our way through his suggestions, then I modify the estimated costs.

Of course, when the estimated costs change, the estimated price to the customer needs to change as well.”

Paul jumped into the discussion. “And, as the company owner, I like to take a look at the detail that goes into the larger job quotes as well. I’m aware of at least half-a-dozen times where this ‘think tank’ review process has kept us from quoting a fixed price that was way too low.

We would have lost our shirt and not hit our gross profit goal on those particular deals if we’d quoted at our initial estimated price. In a couple of instances, our quotes came in higher than other bidders, and we didn’t get the job. But my philosophy is that,

“A JOB LOST AT A LOSS – IS A PROFIT…”

They all grinned. “Yup, I agree,” said Dave. “I could see in my own job cost reports that those ‘loser jobs’ just suck up the gross profit from the winner jobs!

I saw that I’d be further ahead sitting in a lounge chair on my patio than agree to ‘pay’ a customer to do their project at a loss.”

He continued, I once heard a consultant (by the name of Les Cunningham, I believe) suggest what to say to a customer who’s trying to talk me into a rate lower than what I quoted:”

“Tell you what Joe, I’ll lose about $5,000 doing your job at the rate you’re suggesting. So why don’t I just write you a check for $5,000? I’ll end up in the same place but, in the meantime, I’ll save myself a lot of time and effort… Actually, here’s an even better idea! Why don’t I just send you over to my competitor? I hear that he’s been cutting his prices lately. He’ll probably do the job for you and take a loss in the process. That will take care of two problems at once – I won’t be losing money, and my competitor won’t be around for long!”

Everyone around the table got a good chuckle as they pictured the hypothetical exchange. “I’ve paraphrased quite a bit, I’m sure,” said Dave, “but it was something to that effect… Sorry to have interrupted – go ahead, Walt.”

Using Job Cost Detail From the Estimate to PLAN the Job

“So,” Walt continued, “assuming the salesperson is able to finalize the contract with our desired pricing, we then move into the planning phase.

“We work on three things as we create the plan.” He held up his hand and ticked off:

- “Developing and coordinating our operations schedules: Our detailed estimate provides a birds-eye-view of the job process. We can see what’s supposed to happen at each stage. That means we can develop a realistic schedule for the job. When we know what’s required for each job, we can coordinate the workflow between ALL of our in-process projects.”

…  “Communicating the schedule internally and to clients: When we have the schedule set up, it means that we can clearly communicate the process and anticipated scheduling to team leaders and front-line employees. The result? They can ask questions, think ahead, and adjust their workflow when they know ahead of time what the scheduling looks like. Depending on the circumstance, we sometimes also prepare a ‘big-picture’ schedule to share with our customers. It adds to our professional image, and provides them with a sense of security to know we have a specific process and specific timeline for their project.”

“Communicating the schedule internally and to clients: When we have the schedule set up, it means that we can clearly communicate the process and anticipated scheduling to team leaders and front-line employees. The result? They can ask questions, think ahead, and adjust their workflow when they know ahead of time what the scheduling looks like. Depending on the circumstance, we sometimes also prepare a ‘big-picture’ schedule to share with our customers. It adds to our professional image, and provides them with a sense of security to know we have a specific process and specific timeline for their project.”

…- “Communicating our goals: The detailed estimate provides ALL of us with the gross profit goals we need to meet. The job cost lines clarify our time and cost targets for each part of the project. Keeping those goals ‘visible’ helps us all to stay focused on the outcome that we’re shooting for.

A Shift in Perspective

Paul added, “This emphasis on planning was a bit of a ‘perspective shift’ for us. We’re spending more time on the front end to plan and schedule than we used to. I read somewhere – don’t know that this is a proven fact, but it seems logical – that an hour spent in planning, saves four in execution.

Our gross profits are up, and it sure seems that everything is operating more smoothly. We’ve had fewer crisis situations to deal with which has, I think, reduced stress levels – and that’s good for all of us!”

“I can see that we’re running short on time here, so let’s move on to how we use our reports while a job is underway.”

“We have weekly progress meetings,” said Jenn. “Walt heads up the meeting, I attend because I learn a lot that helps me continue to get better at estimating and purchasing, and we include team leaders as well. Sometimes Paul sits in, but he mostly observes and takes notes to share with Walt and me after the meeting.”

“As a group, we review individual project reports to see Estimates vs. Actuals Detail for costs incurred and income invoiced.”

Use “Job Estimates vs. Actuals Detail” to Monitor Jobs

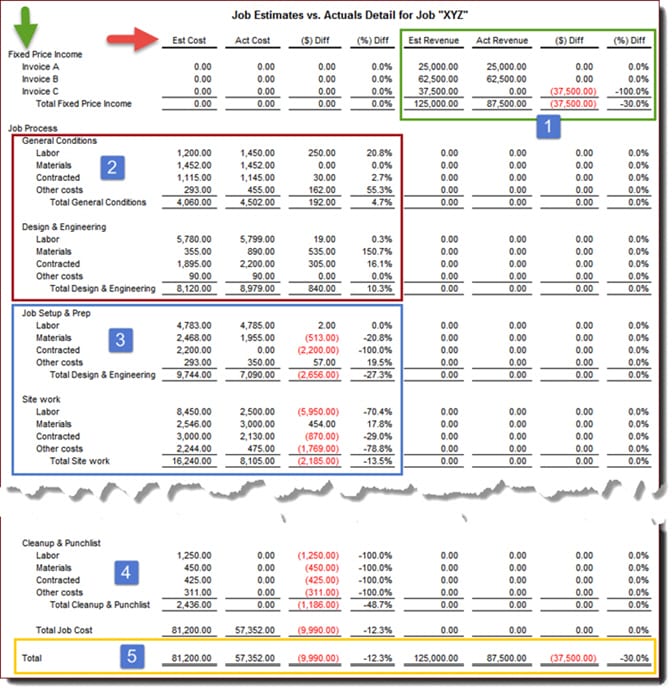

“Here’s an example report for a Fixed Price project. The amounts shown in the ‘Actual’ columns provide a financial-progress overview. For instance, you’ll notice (near blue #1) that we’ve Invoiced the first two (of three anticipated) billings.”

“When it comes to costs, those line items follow the “Income” rows. You’ll see Job Process costs that occur throughout the life of the job under “General Conditions” (blue #2). The remaining cost information is listed in job-stage order.”

“And you’ll see in the red outlined box (see number 2) that the payroll for General Conditions and Design and Engineering labor has been paid. And most of the labor for Job Setup & Prep in the blue box (with a number 3) has also been paid. But Site work Labor has not yet been completely paid.”

“And you’ll see in the red outlined box (see number 2) that the payroll for General Conditions and Design and Engineering labor has been paid. And most of the labor for Job Setup & Prep in the blue box (with a number 3) has also been paid. But Site work Labor has not yet been completely paid.”

“So, if I’m understanding this part correctly,” said Dave, “from a progress perspective on just labor,

- The lines for General Conditions Labor, Design and Engineering Labor, and Job Setup & Prep Labor look as though they are a bit over budget and should be largely completed.

- We’re part-way through the Site Work labor, right?

- And obviously, we haven’t started any work on any of the Cleanup & Punchlist stage of work – section number 4 – at the end of the job.”

“You’ve got it!” said Jenn.

Comparing Reports to On-Site Knowledge

Walt picked up the conversation. “So, generally speaking, we can review these reports to see how costs are lining up against estimates. Then we compare that to what we know about the job.”

“Let’s say we know – from being in touch with the actual job – only about 40% of the labor has been completed on a given job stage. But then we see in one of our reports that we’ve already used 60% of our estimated cost.”

“Granted, that’s a bad situation. BUT by pinpointing the problem, we can follow up right away to find out what’s going wrong. Then we can work towards getting that part of the job back under control.

Without this kind of ‘early warning system’, that problem could continue without our knowledge. It would then have a more significant negative impact.

However, if we know that a job stage has been completed and it’s under budget, we can congratulate or reward employees for a job well-done. They like that – and so do we!”

Walt’s phone buzzed, and he grabbed it out of his pocket. “I’m sorry, but I’m going to have to duck out for a minute to return this call. I’ll be right back.” Paul glanced at his own phone and nodded. “OK, this looks like a good time for a quick break. Let’s meet back here in five minutes, and then we can wrap up…”

The Final Installment…

Don’t Miss the Final Installment of our series “A Tale of 4 Companies: A Gross Profit & Job Cost Drama,” Part V – Weird Numbers and Fine-Tuning Profits. Jenn and Paul talk about what happens when they spot “weird numbers” and how they use their reports after the job is finalized.

Looking for a prebuilt Chart of Accounts, Cost Codes, and Job Cost Reports

for your QuickBooks desktop software?

Click here or on the image above to check out AccountingPRO™

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“I’ve been looking for someone who could teach me practical accounting methods and best practices for our business, so I didn’t have to hire a bookkeeper. Diane and her staff are easy to talk to, work with and learn from. The consulting calls are incredibly beneficial, and the video lessons are a wealth of information – there for me whenever I need them. This has the investment I needed to make for me and our business!”

See More Customer and Client Comments