Labor Profit Tip #1: For More Accurate Job Estimates, Include Fully-Burdened Labor Costs for Each Employee

What Will The Labor on That Job REALLY Cost?

When You Don’t Include Fully-Burdened Labor Cost Info, You May Be In For A Surprise…

If you’re not using fully-burdened labor costs for every employee’s work included in your estimates, you may end up losing money on that job!

But, when you know how much each employee truly costs per production hour, you can be more accurate with your estimates.

Why does that matter? When you know your true costs, you can charge what you need to charge to protect your profit margin.

Fully-Burdened Labor Costs vs. Actual Labor Utilization

We’ve helped thousands of companies improve their bottom line through effective accounting. While doing that, we’ve found two consistent issues that cause companies to lose profits:

- Not including accurate, fully-burdened labor rates for every employee hour included in their bids.

- Once they get the job, they shift work from the lower-cost employee hours included in the bid to more skilled and expensive employees to do the work, resulting in losing profits.

Let me give you an example to illustrate:

How Labor Costs Can Vary vs. Estimate – Even When Estimated Hours Are the Same…

Suppose you need to estimate the labor cost for 2 jobs.

Each project will take about the same amount of time (40 hours), and you know your fully-burdened labor cost for each employee you need on each job.

But when it comes time to do the job, you know that the second job is more complex, so (to ensure it’s done correctly) you use a different combination of employee experience and knowledge.

Let’s “sharpen the pencil” to see the results……

Labor Cost Differences: Job Estimate vs. Actual

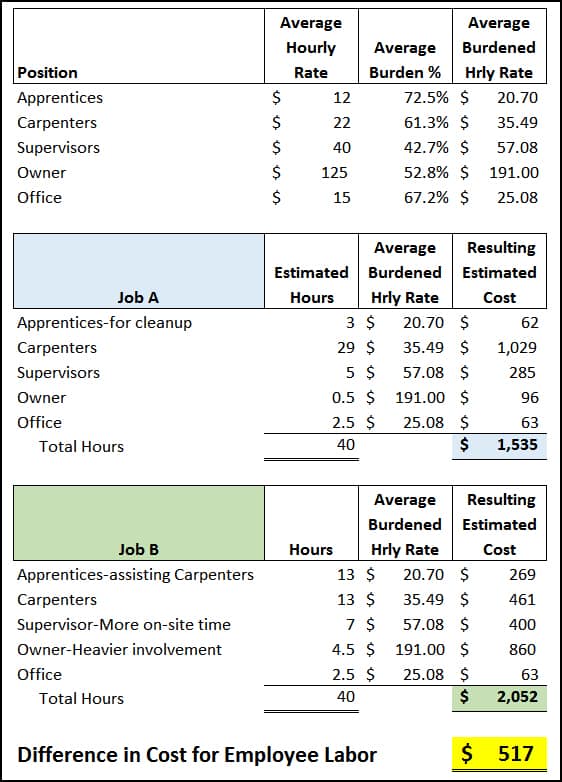

See the computed results for our example (below):

- In the first section, you’ll see fully-burdened burdened rates for different positions.

(Please note the significant difference between employees’ average hourly rates and average burdened labor costs.)

… - You’ll notice labor cost totals for the first job (Job A) in blue in the second grid (below).

… - Labor cost totals for the second job (Job B) appear in green in the third segment (below).

… - You’ll find the difference in labor costs at the bottom (in yellow).

…

Even though each job requires the same number of hours, look at the wide variance in estimated labor costs… $517.

Amazingly, that means the labor costs for Job B are 34% higher than for Job A!

Why? It’s due to:

- The different fully-burdened labor COSTS for each TYPE of employee – as well as

- How you assign HOURS to specific people working on the job.

In this example, without these specific numbers at hand, you wouldn’t have been able to compute and see how dramatically different your costs could be!

WHAT IMPACT WILL ACCURATE, FULLY-BURDENED LABOR COSTS HAVE ON YOUR ESTIMATES?

When you can see accurate information about each employee’s fully-burdened labor costs, you can arrive at more accurate labor cost estimates. Please consider the following:

- What impact could this knowledge (about your employees’ fully-burdened labor costs) have on your pricing decisions?

- How will those new decisions impact your profitability?

“Fully-Burdened Labor Cost”

I.e., what it costs an employer for an employee to produce work for a specific period of time…

(…usually shown as a “per-hour” rate.)

Click the image above to learn more about our Excel-based tool that will help you learn everything you need to know about your employee costs and billing rates…

Disclaimer: All numbers presented in this article are theoretical and should not be construed as industry averages. You will need to use your own eCPA (employee Cost & Pricing Analyzer) to see your own company’s true, fully-burdened costs.

This is just one in a series of useful tips that show how you can add to your bottom line when you know each employee’s true hourly cost!

Related Articles: Intro to Labor Burden Series | Part 2 | Part 3

Frequently Asked Questions About Fully-Burdened Labor Costs and Job Estimating

What are fully-burdened labor costs?

Fully-burdened labor costs refer to the complete, comprehensive cost of employing an individual beyond just their base salary or hourly wage. It encompasses all direct and indirect costs associated with an employee. By understanding the fully-burdened labor cost, companies can get a clearer picture of the total expenses related to each employee.

The components of fully-burdened labor costs typically include:

Base Salary/Wages: This is the base pay an employee receives, whether salaried or hourly.

Taxes: This includes employer portions of payroll taxes like Social Security, Medicare, unemployment taxes, and any other mandatory taxes, depending on the jurisdiction.

Benefits: This covers costs related to health insurance, dental insurance, life insurance, retirement contributions (like 401(k) matches), disability insurance, and any other benefits offered to employees.

Bonuses and Commissions: Any performance-based incentives that the employee might earn.

Overhead: Costs associated with an employee’s use of office space, utilities, equipment, and other general overhead items.

Training and Development: Costs associated with onboarding, training, courses, workshops, seminars, and other professional development opportunities.

Vacation and Paid Time Off: Although the employee isn’t working during these times, they are still being paid, so this cost must be included.

Sick Days and Personal Days: Like vacation time, these are periods when an employee might not be contributing to work but is still receiving compensation.

Other Employee-Related Expenses: This can be a catch-all category for any other costs associated with the employee, such as uniforms, tools, travel expenses, meals, etc.

To determine the fully-burdened labor cost for an employee, a company would add up all of these components for a given period (e.g., annually) and then can break it down to an hourly or monthly rate if needed. This provides a more accurate understanding of the true cost of an employee, which is often significantly higher than just their base salary or wage.

How do I convert fully-burdened labor costs into a fully-burdened labor rate?

Fully-burdened labor costs become more valuable as a management tool when converted into an hourly fully-burdened labor rate, which tells you your actual cost to employ that individual per hour.

To calculate fully-burdened labor rate:

- Determine Total Annual Labor Costs: First, calculate the total annual fully-burdened labor costs for the employee. This should include:

Base Salary/Wages

Taxes (employer portions)

Benefits

Bonuses and Commissions

Overhead

Training and Development

Cost of Vacation, Sick Days, and Personal Days

Other Employee-Related Expenses

- Determine Total Annual Working Hours:

Start with the standard work year, which is typically 2,080 hours (52 weeks x 40 hours).

Deduct annual vacation, holidays, sick days, and other non-working days (paid time off). For example, if an employee gets 2 weeks of vacation, 10 holidays, and 5 sick days a year, that’s a total of 15 days or 120 hours.

Thus, the working hours would be: 2,080 hours – 120 hours = 1,960 hours.

- Calculate the Fully-Burdened Labor Rate:

Divide the total annual fully-burdened labor costs by the total annual working hours to get the fully-burdened labor rate.

For example, if the total annual fully-burdened labor costs for an employee is $100,000 and they work 1,960 hours a year:

Fully-burdened labor rate = $100,000 ÷ 1,960 hours = $51.02 per hour.

Using this method, you can determine the true hourly cost of employing an individual when all associated costs are considered. This can be especially valuable when pricing services, bidding on contracts, or evaluating the cost-effectiveness of hiring decisions.

Fully-Burdened Labor Rate Calculator

Want to save time and effort calculating your fully-burdened labor rates for each employee/employee class? Our eCPA: Employee Cost & Pricing Analyzer will save you hours while ensuring you get an accurate answer. Learn more here.

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Diane is a pleasure to work with. She’s committed to my success and has a mastery of how to blend accounting principles with Quickbooks capabilities to address our main needs. The work we have done together has been instrumental in transitioning our company out of a start-up phase into more of an established growth phase.

She tailored her approach to fit our business by listening to how we do what we do, and I now have everything in place to “keep score” and measure profitability more precisely.”

See More Customer and Client Comments