“Why aren’t we making more money? We’re busier than ever, I’m working harder than ever, but things just aren’t coming together like they should!”

If this story sounds or feels familiar, you may want to sit in on this meeting to pick up some ideas on how to create Estimate vs. Actual Reports…

It Just Doesn’t Make Sense!!!

Matt, the company owner, was nearing the end of his Monday morning Project Managers’ meeting. They were at the point where they normally reviewed financial results.

He hadn’t taken the time to look through last month’s numbers before the meeting started. Now, he pulled the report from the remaining pile of papers and quickly absorbed the unpleasant information that it revealed.

Instantly, Matt could feel his blood pressure rising. “I can’t believe that we’re showing another loss this month! It just doesn’t make sense…we have so many jobs going – we should be making money, not losing it!” he exclaimed.

Instantly, Matt could feel his blood pressure rising. “I can’t believe that we’re showing another loss this month! It just doesn’t make sense…we have so many jobs going – we should be making money, not losing it!” he exclaimed.

He couldn’t get his eyes off that bottom line on his Profit & Loss report, which was “in the red”…

It wasn’t the first meeting he’d had with his Project Managers where the company showed a loss. As a result, he’d beseeched both managers and employees to help contain costs. He’d reasoned, pleaded, implored, and even threatened. But nothing seemed to change.

“OK,” he thought, “Time for a new approach.” Instead of losing his cool, he looked around the table and asked,

“So, does ANYbody have ANY idea about what’s happening out there? Help me out here guys!”

What the “Big Boys” Do with Their Estimate vs. Actual Reports

After some quick glances at the other Project Managers, the primary Construction Manager, Tom, spoke up. “Umm, I don’t think that we know our cost goals. If we could see what they are, we can do better at hitting them. And if we can’t hit our estimated cost goals, maybe we’re not charging enough to cover our costs and still make a profit,” he ventured.

“So, what do you mean?” replied Matt (somewhat defensively since, as the owner, he did most of the sales and estimating for his company).

“Well”, replied Tom, “at my last company, for each of our projects, we got to see Estimate vs. Actual reports that showed our Estimated vs. Actual cost comparisons. Before we even started, the Estimated Cost report showed us what the various parts of the job should cost. Those were the goals we needed to meet for the company to make a decent profit on that job.”

“Well”, replied Tom, “at my last company, for each of our projects, we got to see Estimate vs. Actual reports that showed our Estimated vs. Actual cost comparisons. Before we even started, the Estimated Cost report showed us what the various parts of the job should cost. Those were the goals we needed to meet for the company to make a decent profit on that job.”

Tom was in his early 60s and had worked at several large construction companies during his career. Now he was warming up to share his experience about ‘how the big boys do it’. In this case, the other PMs were NOT rolling their eyes. Instead, they were nodding their heads in agreement…

“Then, while the job was underway, we checked our project reports to see how we were doing against our Estimated costs. We could see if we were over or under in various areas, and then we could dig in further to see WHY.” He listed:

- “We could figure out if it was something we could fix. If it was, we could fix it before the whole job went sideways.”

- “Sometimes the differences were due to Change Orders that hadn’t been turned in, and we could get them recorded, so we could collect on them.”

- And sometimes, the estimate was off. We used that info to let the estimator know, which helped ensure that we got the estimate right the next time.”

It Just Doesn’t Make Sense – To Run Your Business Without the Right Numbers!

Tom continued, “I’ve asked Helen for that sort of report, but she says that our system isn’t set up to do that. I feel kind of blind without that data.”

Of course, thought Matt, Data. Sigh.

Helen, his (very competent) full-charge bookkeeper, had been “suggesting” (for years) that Matt needed to make some changes in his estimating process.

But, Matt had done estimates in Excel for years!

He was comfortable with Excel because it helped him with various complex math calculations. and he liked the flexibility when he needed to make last-minute changes. Then he’d send potential customers his quote in a Word document with summarized numbers. However, Helen thought they should…

Start using the Estimates feature in QuickBooks desktop for estimates, OR

Start using the Estimates feature in QuickBooks desktop for estimates, OR - If Matt wanted to continue with Excel, enter his final, detailed estimated costs (and income) into QuickBooks for easier tracking.

But he’d resisted. He just couldn’t see the point in (what he’d always considered) another layer of “double-entry busy work”.

However, Matt admitted to himself, based on what Tom was saying, I can see how it would make life easier if we could see the project costs to date next to the estimated figures. And, it might help to keep jobs on track while they were in motion, rather than just seeing the final numbers after the project was completed.

And, to top it off, he’d make Helen really happy when she got to tell him, “I told you so!” (LOTS) of times! He sighed to himself and thought, “Oh well, no solution is perfect!”

He’d just have to let her know that she’d been right all along. Life would eventually get better…

Consultant’s Corner: Estimated Costs → Estimate vs. Actual Reports

Matt’s comfort level and idea that Excel is easier for Estimates is fairly common among business owners and estimators. What Matt hadn’t understood (until now), is that this approach typically creates an “information disconnect”.

Matt’s comfort level and idea that Excel is easier for Estimates is fairly common among business owners and estimators. What Matt hadn’t understood (until now), is that this approach typically creates an “information disconnect”.

Using Excel as a standalone solution meant that his estimated costs were sitting in a separate Excel file that his project managers were not able to see.

Then his current actual costs were posted and reported in QuickBooks. That left no easy or reliable way to compare one set of numbers against the other.

Ironically, if Matt had standardized the process, the task of creating Estimates in QuickBooks would have been even easier than in Excel. AND, it would likely have simplified his purchasing and invoicing process.

How Does That Simplified Process Work?

- As soon as estimated costs are entered into the QuickBooks Estimate form, it takes just the push of a button to copy that information into each vendor’s Purchase Order.

- Then, Purchase Orders can easily be converted into Bills as they arrive.

- Additionally, Invoices can be generated directly from Estimates, either as a percentage of completion – or for a specific dollar amount (for specific job phases, or for the entire job).

Of course, the primary management bonus is having real-time reports where Matt and his Project Managers can see ACTUAL costs – as they are incurred on each project – compared to the Estimated costs.

AND, as Tom pointed out, Estimates vs. Actual reports make missing Change Orders so much easier to spot and recover!

Of course, it does take a front-end investment of time and energy to establish the Item List, and map the Items to the correct accounts so the reports display correctly. But the payback, over time, can be impre$$ive…

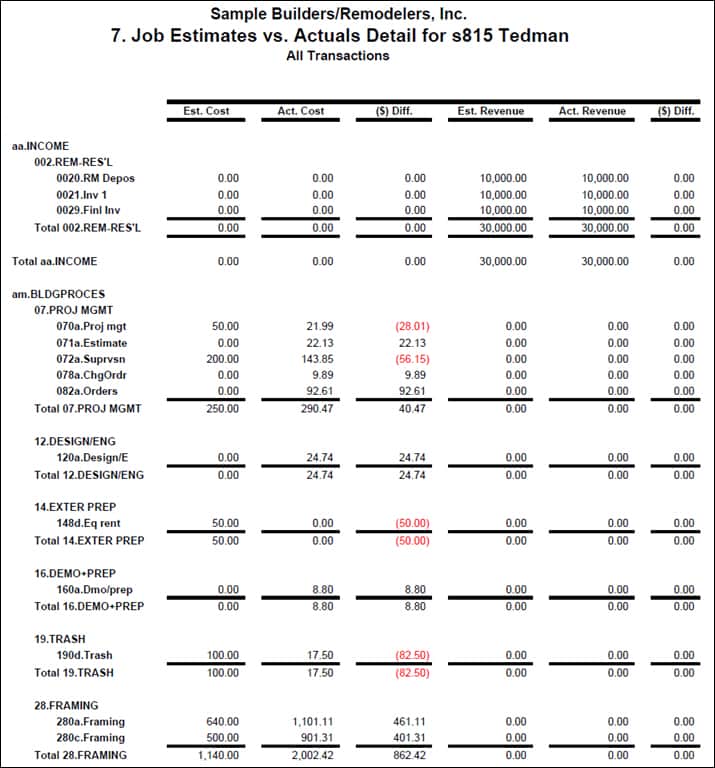

Example Section of a QuickBooks Estimate vs. Actual Job-Cost Report

Notes:

- This report is from a sample “training” file that includes a variety of small example transactions, so please ignore the dollar amounts shown – instead, please focus on the format!

- A complete report would also show totals for each column at the bottom.

Fast Forward/Rewind

Let’s see how this portion of the Monday morning meeting COULD have gone if Matt had been using the Estimates feature and Estimates vs. Actuals reports in QuickBooks.

“Okay, gentlemen,” Matt said to his Production Managers during their latest Monday AM meeting. “From these Estimate vs. Actual Job-Costing Reports, it looks like Job #811-Henley Square has a few cost overruns. Tom, what’s the plan?”

Everyone looked at Tom, who smiled and replied, “Don’t worry, I’m on top of it. Those costs came from a couple of major Change Orders that our customer hadn’t signed off on. That’s why they weren’t entered into our Estimated costs. I followed up with them, and I have the sign off on those two Change Orders here in my hand, so we’ll finish the project right-side up.” He gave Matt a thumbs up.

Matt nodded in approval, “Good. I’m also thinking that we need to reassess our pricing for flooring and installation. I’ve noticed that our hard material and installation costs have been increasing slowly. They’re up about 7% over the past quarter. We should adjust our pricing to reflect that.”

“Agreed,” said the Project Managers, in unison, as they pushed their chairs away from the table, and headed out to lunch…

Do YOU Have a Similar Problem?

Here are a few questions to think about:

- Are you missing these types of Estimate-to-Actual reports for your larger jobs?

… - If you DO have these types of reports available, are you reviewing them weekly or (worst-case) every other week to make sure that you’re “on target?” Or to discover if you’re missing any Change Orders?

… - As a business owner or bookkeeper, if you’re missing out on this kind of information, how does it make you feel regarding your ability to confidently do your job and/or manage your business?

What if there was a fast and easy way to install a bullet-proof pre-built system designed to deliver Estimates and Estimate vs. Actual job-cost reports for your construction business?

Well, there is! The solution: AccountingPRO™.

The AccountingPRO™ system is specifically designed for construction business owners and bookkeepers who are too busy in their business to figure out how to organize the financial side of their business.

If you’re sick and tired of trying to run your business with a sub-standard set of numbers and missing financial data, then this is the time to check out AccountingPRO™.

Click the image below to see how easy it can be to get your business math back under control.

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“The task of restructuring and customizing our QB file seemed overwhelming. I’m happy to report that it turned out to be an extremely enlightening experience. After Diane’s comprehensive assessment of our QB file, we were off and running. Action plan in hand, we tackled rebuilding our COA and setting up items for job costing and payroll purposes. Our sessions were very productive. Diane’s QB expertise and attention to detail, not to mention her impressive accounting background, allowed us to establish an ideal setup complete with professional looking forms and reports that are customized to our specific job costing needs. I was impressed by her vast experience with and knowledge of the Contractors Edition of QB. She was able to help us get over various hurdles to deliver the desired results. There wasn’t anything she was unable to handle. She was punctual, professional and patient. I’m so grateful to have crossed paths with Diane Gilson and her staff at Info Plus+ Accounting. It is very reassuring knowing that she is only a phone call away. I’m looking forward to future work with her as well as continued viewing of her very educational training videos. I highly recommend her as a QB ProAdvisor. Her work is outstanding!”

See More Customer and Client Comments