Labor Costs Are a Risky Part of Your Business. Make an Immediate Impact on Your Bottom Line by Heading off Costly Labor Over-runs Before They Get Out of Hand.

7 Ways to Reduce Labor Costs

- Know and use your true, fully burdened labor costs when estimating.

- Increase estimating accuracy by using costs based on specific employees (or averages based on employee levels).

- Monitor what level of employee is working on various aspects of the job.

- Continually monitor time and cost progress against estimates.

- If a job stage is taking longer than estimated, try to find out why and see if the problem can be addressed as quickly as possible.

- Use what you learn to improve internal processes.

- Use job-cost reports to refine your estimates for future jobs.

Keys To Reducing Labor Costs and Labor Cost Over-runs

1. Make sure you are using fully-burdened labor costs in your bids.

Unless you are using full labor rate burdens in your bids, you will always underestimate the actual cost of the labor to do the job.

2. Carefully monitor the job while in process to ensure the mix of employees working the job is consistent with what is included in your bid.

While it may be easier to just send an available employee out on a job, if their fully-burdened labor rate is higher than what you bid, you will incur cost over-runs.

3. Carefully monitor the job while in process to ensure the hours spent on the job are consistent with what is included in your bid.

Every extra hour spent over your estimated hours will be a cost overrun.

Estimated vs. Actual Labor Costs

ILLUSTRATION 1

Use Fully-Burdened Labor Costs

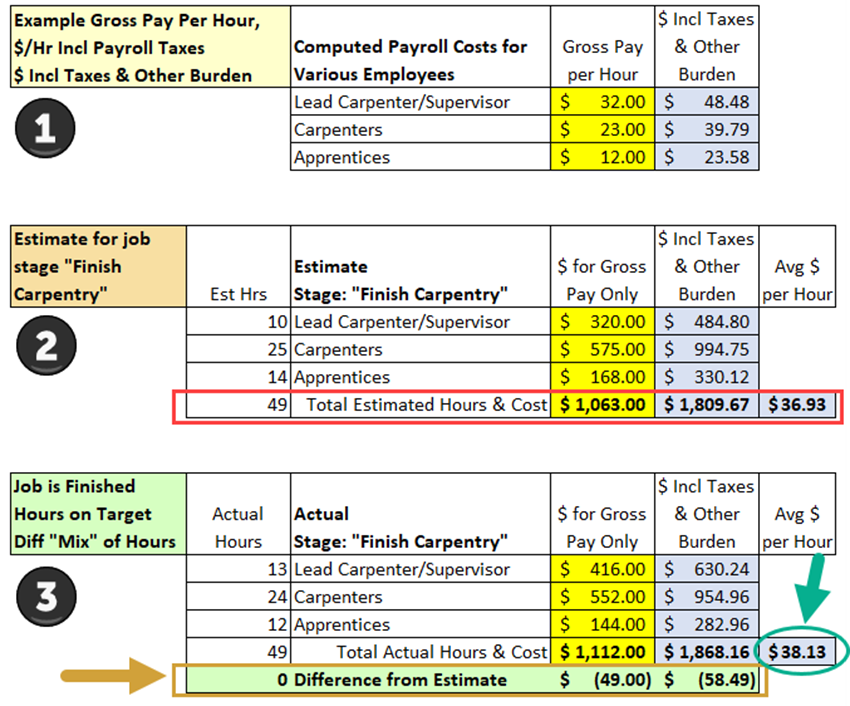

1. The first section of Illustration 1 shows three different levels of employees. You’ll see both Gross Pay per Hour (in yellow) and the full dollar amount (Including Taxes and Other Burden – in blue) for each.

2. The middle section of the illustration above shows just the “Finish Carpentry” section of a job. In the leftmost column, you’ll see 49 estimated hours. The columns on the right show gross pay only as well as fully-burdened costs (taxes and other burden costs).

You’ll notice that your TRUE (fully burdened) costs of $1,809.67 are significantly higher than the gross payroll costs of $1,063. (In this case, the difference is $746.67.)

WHAT THIS MEANS: Unless you’re seeing fully burdened costs per hour in your job-costing, you are NOT seeing the true costs of your labor.

Make Sure Labor Division of Work Is Consistent With Your Bid

3. The bottom (third) section shows an example of results where the crew completes the job within the estimated 49 hours. BUT, the section highlighted with the gold arrow and box shows that the actual hours worked by different employees were different than estimated. You’ll also notice that the average cost per hour changed from $36.93 per hour to $38.13 per hour (aqua-colored arrow and circle).

3. The bottom (third) section shows an example of results where the crew completes the job within the estimated 49 hours. BUT, the section highlighted with the gold arrow and box shows that the actual hours worked by different employees were different than estimated. You’ll also notice that the average cost per hour changed from $36.93 per hour to $38.13 per hour (aqua-colored arrow and circle).

This “who-does-what-time-shift” created a cost overage of $58.49 (3.2% above the estimate).

WHAT THIS MEANS: When work gets shifted between employees with different hourly rates, your job costs change…

Ensure Labor Actual Hours Worked Matches Bid Amount

ILLUSTRATION 2

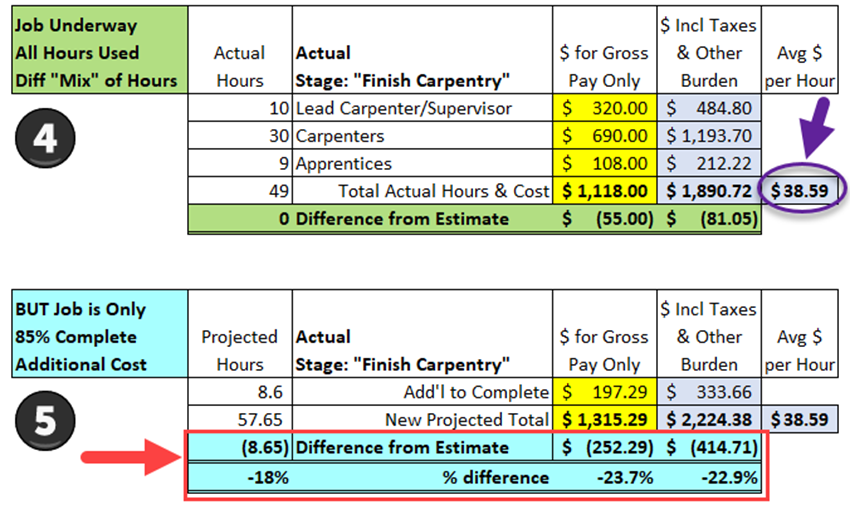

4. In the top section of illustration #2, we’re still at 49 hours, but to continue with the point made in comment #3 above, I’ve shifted the “who-does-what” hours again. You’ll see the average hourly rate has gone up from $38.13 to $38.59, and our difference from the estimated amount is $81.05 (see the olive green row).

5. BUT THERE’S A PROBLEM! Even though we’ve worked the estimated 49 hours on this portion of the job, it isn’t done. Our supervisor lets us know that he believes we’re only about 85% of the way through.

So, I’ve added another 8.65 hours in the same proportion of costs to date. The result? It looks like we’re going to be $414.71 (22.9%) over budget!

WHAT THIS MEANS: Labor costs can spin out of control very quickly!

…

QuickBooks Job Cost Reporting

ACCOUNTING VIEW:

WHAT THIS WOULD LOOK LIKE IN YOUR QUICKBOOKS JOB-COST REPORTS

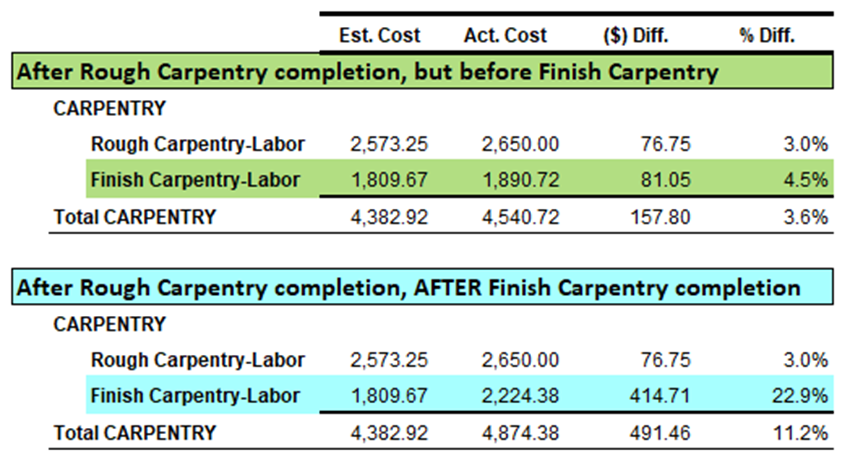

Assuming that you’re using fully-burdened labor costs in your job-cost reports, this is what an Estimated vs. Actual Job Cost Report would look like if you look at both the Rough Carpentry (not previously illustrated) and the Finish Carpentry outlined above:

ILLUSTRATION 3

The green notes and rows show what you’d see in an “interim” report, and the aqua notes and rows show what you’d see after all costs have been entered at the conclusion of the job.

NOTE: Of course, the notes and colors wouldn’t be shown in a standard report and to keep the illustration a manageable size, I’ve excluded other job stages and income columns that you’d normally find in an Estimated vs. Actual Job Cost Report.

How To Reduce Labor Cost Over-runs

- Regularly review and compare actual burdened job costs to your estimated burdened job costs while the job is in process (not waiting until it is complete because, by then, it’s too late to make adjustments to bring your costs into line.) Use the information to:

- Take immediate corrective action if needed (and possible) OR

- Use the results to refine your estimates for future jobs.

- Have you had a chance to run some of your own numbers? If so, what’s the FIRST way you’ll use your information? To share your insights, please email me from our Contact Info Plus Accounting page …

- Click here to access a Labor Burden Calculator (eCPA employee Cost & Pricing Analyzer™).

I hope you’ve enjoyed insights about how to prevent labor overruns. It’s one of several articles related to labor costs) that demonstrates how you can add to your bottom line when you know each employee’s true hourly cost!

Disclaimer: All numbers presented here are theoretical and should not be construed as industry averages. You will need to use your own eCPA to see your own company’s true, fully burdened costs.

Related Articles: Labor Profit Time #3: Your Gross Profit Numbers May Be Misleading | Labor Profit Tip #5: The Secret to Making Better Hiring Decisions

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“We have used Diane Gilson as a resource for job cost specific and general QuickBooks applications. She is a great resource and has provided useful advice re structure, what to do first, how to modify reports for specific uses, etc. Her responses have been timely and to the point. There is no doubt that we will use her in the future.”

See More Customer and Client Comments