These best practices for QuickBooks payments can improve your profitability as well as the speed and accuracy of your incoming and outgoing payments.

These best practices for QuickBooks payments can improve your profitability as well as the speed and accuracy of your incoming and outgoing payments.

In the case of best practices for QuickBooks payments, the rewards are clear.

- Pump up your cash flow. (More cash-on-hand means less-stressed owners + happier, more-responsive vendors.)

- Eliminate costly late fees and build your reputation. (Imagine: No more nagging creditor calls!)

- Save time. (Efficiency means you can focus on other critical profit-building activities.)

1. Set up your Company File Preferences to take advantage of QuickBooks’ built-in features.

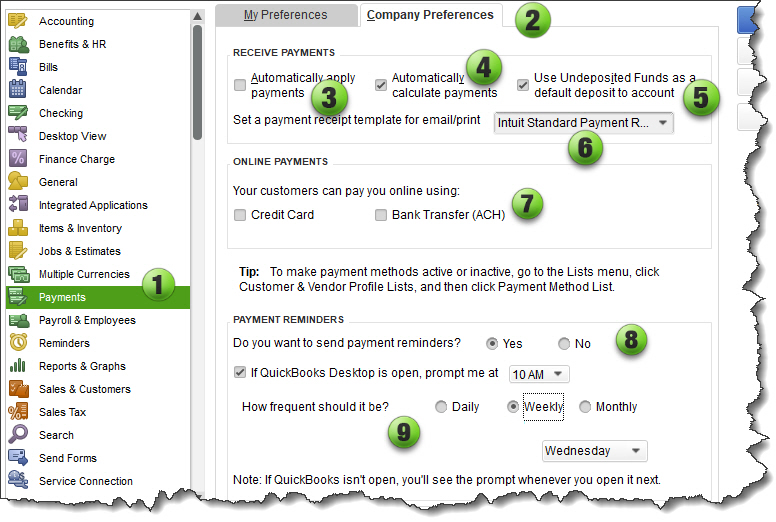

Here’s a screenshot from the Company Preferences in QuickBooks. The numbered explanations, below, show incoming payment options.

-

- Select Edit>Preferences from the main menu, and then the Payments option from the left-hand menu.

- Select the Company Preferences tab.

- We usually suggest that you uncheck the Automatically apply payments box.

Why? When you receive a payment, this lets you decide exactly how you want to match incoming payments against outstanding customer Invoices. (It also prevents QuickBooks from automatically assigning customer credits to Invoices.)

INSIGHT: Re-assigning either linked payments (or credits) after the fact can be complex and time-consuming! - Automatically calculate payments: Checking this box means that if you DON’T initially enter a PAYMENT AMOUNT in the top of the Customer Payment screen, QuickBooks will auto-calculate the amount received as you select each Invoice in the table.

- Use Undeposited Funds as a default deposit to account: If you ever receive more than one payment in a day, QuickBooks will hold those payments in this account until you are ready to group payments you select into a deposit that will match your bank statement. We generally recommend checking this Preference, as it makes reconciling much easier.

- QuickBooks now has a Payment Receipt that you can print or email to customers. You can use the default (as shown above) OR you can go to the Templates to customize the form for your company.

- Your customers can pay you online using: When you have a QuickBooks Payments account you can choose to receive credit card payments, bank transfers, or either from your customers.

- Do you want to send payment reminders? Select “Yes” or “No.” (Regular reminders can help your customers remember to get those payments headed into your bank account.)

- How frequent should it be? Choose how frequently (and which day of the week or month) you’d like to remind your customers.

2. Take full advantage of the tools available for electronic financial processing. For example…

- Get a QuickBooks Payment account so you can accept credit cards and direct deposits (ACH).

(INSIGHT: As Intuit Solution Providers, we can help you get reduced processing rates. Please contact us to learn about the options.) - Take advantage of electronic payment options so you can accept payments when you’re out of the office.

- Some banks have check-scanning features that allow you to make deposits without an extra trip to the bank.

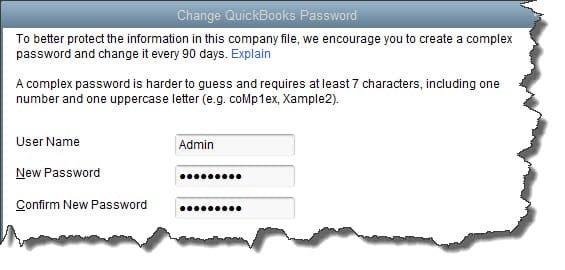

3. Even if you’re a sole proprietor, password-protect your QuickBooks file.

Those easily-accessible processes you’ve set up to pay (and be paid) could be used by an unauthorized individual.

You’re out of the office or occupied with something else sometimes, aren’t you? Is anyone else ever in your office? Do you shut down your computer, and lock your door every time you leave? (Really, who does all of those things?)

That’s why it’s so important to secure your QuickBooks company file with a password.

It is EXTREMELY important to protect your customer’s payment information as if it was your own! If you don’t, you could be held legally responsible. Not a pretty picture…

4. Cross-train your accounting staff, and divide duties so that there are some ‘checks and balances.’

- Cross-training helps to ensure that critical work can always get done.

- Dividing duties can prevent (or expose) unauthorized payments. Even if you have only one other person handling the books there are ways to build in basic cross-checks that help to prevent or detect fraud.

Won’t happen to you? Remember:

“Internal fraud is almost always committed by people you trust.”

5. Be diligent about billing and collections.

- Bill (Invoice) on a set schedule! Letting your billings lag because you’re too busy to do them, sends a message to customers that you aren’t that concerned about getting paid.

- Don’t let billings mount up into large dollar amounts. These can create shock (not awe!) for your customers. Frequent, lower-dollar billings keep your customer “in the know” and you are more likely to get paid on a timely basis.

- Many companies require up-front earnest money deposits. You’ll especially want to adopt a “deposit required” if you begin to incur costs before you start receiving funds from a customer.

- Follow up on overdue accounts immediately! DON’T let them sit, or be afraid to reach out to discuss payment options. The rule of thumb is that the longer an account goes unpaid, the lower the chance of receiving the money you are owed.

- When you have established good relationships with customers, it’s tempting to want to help them out by extending credit or by delaying due dates. Save this generosity for extreme cases.

6. Set up a schedule to review critical reports.

Many company owners and management teams run reports on an “as-wanted” basis. That’s not a reliable way to stay on top of your business!

It’s critical to create, customize, monitor, and analyze at least the following management reports on a weekly or (worst case) monthly basis. Many reports in QuickBooks are self-explanatory, but it takes a trained eye to spot trouble brewing (or profit opportunities) in your:

- Accounts Receivable Aging Summary

- Accounts Payable Aging Summary

- Job Cost reports

- Estimate vs. Actual Job Cost reports

- Company Profit & Loss

- Company Balance Sheet

- Company Budget vs. Actual Report

We can help you determine which reports you should be looking at. If you’d like “another set of eyes” to help provide some perspective on a one-time or recurring basis, let us know. We’ve looked at thousands of reports and can help provide insights…

7. Notate everything you can.

Whether or not the IRS ever audits you, you should include descriptive details where possible. You enter MANY transactions into your company file, and human memories are short. If you (or anyone following behind you) would ever need to know what happened, or why you made a specific entry, deposited funds, withdrew funds from the bank, or wrote off an outstanding balance, MEMO IT!

NOTE: This tip comes from years of helping people research and clean up “mystery entries” that they (or others) have made…

8. Negotiate for, and take advantage of vendor “prompt payment” discounts.

Examine existing incoming vendor Bills to see if they offer discounts. E.g., 2/10 net 20 means you can pay 2% less if you pay within 10 days of their Invoice date. (And if you don’t pay within 10 days, the total is due in 20 days, regardless.)

2% on $10,000 comes to a $200 savings (nothing to sneeze at).

BUT, let’s look at it another way. If you miss the discount date you are paying $200 to hang on to your money another 10 days (until the 20-day payment deadline arrives). When you pay $200 to keep your money for those extra 10 days, it comes to an effective annualized interest rate of 73%!!! I.e., You are paying 73% interest when you DON’T take advantage of the discount.

DON’T MISS THOSE DISCOUNT DATES!

MONEY-MAKING TIP: To avoid missing the discounts, I suggest that you change the name of vendors to display their discount rates. For example: “Local Lumberyard-2/10 Discount.”

9. Save time and frustration at year-end: enter tax info for any potential IRS Form 1099 contractor when you create their Vendor record.

It’s critical that you create and dispatch 1099s to everyone who is eligible. That’s why QuickBooks has a built-in tool for doing this.

Tip: Require contractors to provide this information to you BEFORE you issue their first payment. It’s a whole lot easier to obtain their information at that point. (It’s amazing how much more difficult it can be to track down this information when it gets to be December or January and you’re under the gun to issue those 1099’s!)

Summary

QuickBooks is easy to use, but its advanced features – especially job-cost-related options – may require deeper explanations and practice. And you’ll find it even easier to use if you learn the theory and concepts behind the step-by-step procedures.

If you want a more comprehensive understanding of QuickBooks accounting and payments best practices, talk to us. We have training classes, construction templates for QuickBooks, and one-to-one training. We can also help you find other helpful resources.

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Diane was very prompt and punctual on our web and phone calls. We had to design a whole new QB architecture which she guided us through by phone and web, much harder than in person but she got it done very efficiently. Our system is now working as it should, especially the job costing portion, which we required heavy modification of. Very creative in her use of QB to overcome some specialty items that were of an Industry not familiar to her.”

See More Customer and Client Comments