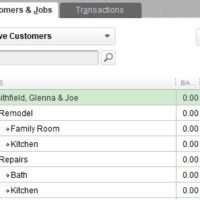

If you’re struggling to understand or measure your labor burden and its effect on profit, let BuildYourNumbers.com help you with our job cost and accounting tutorials. Labor Burden & Profits: Connect the Dots! Got employees? If so… What’s it cost to put them “into the field”? What should you be charging for their time? Should …